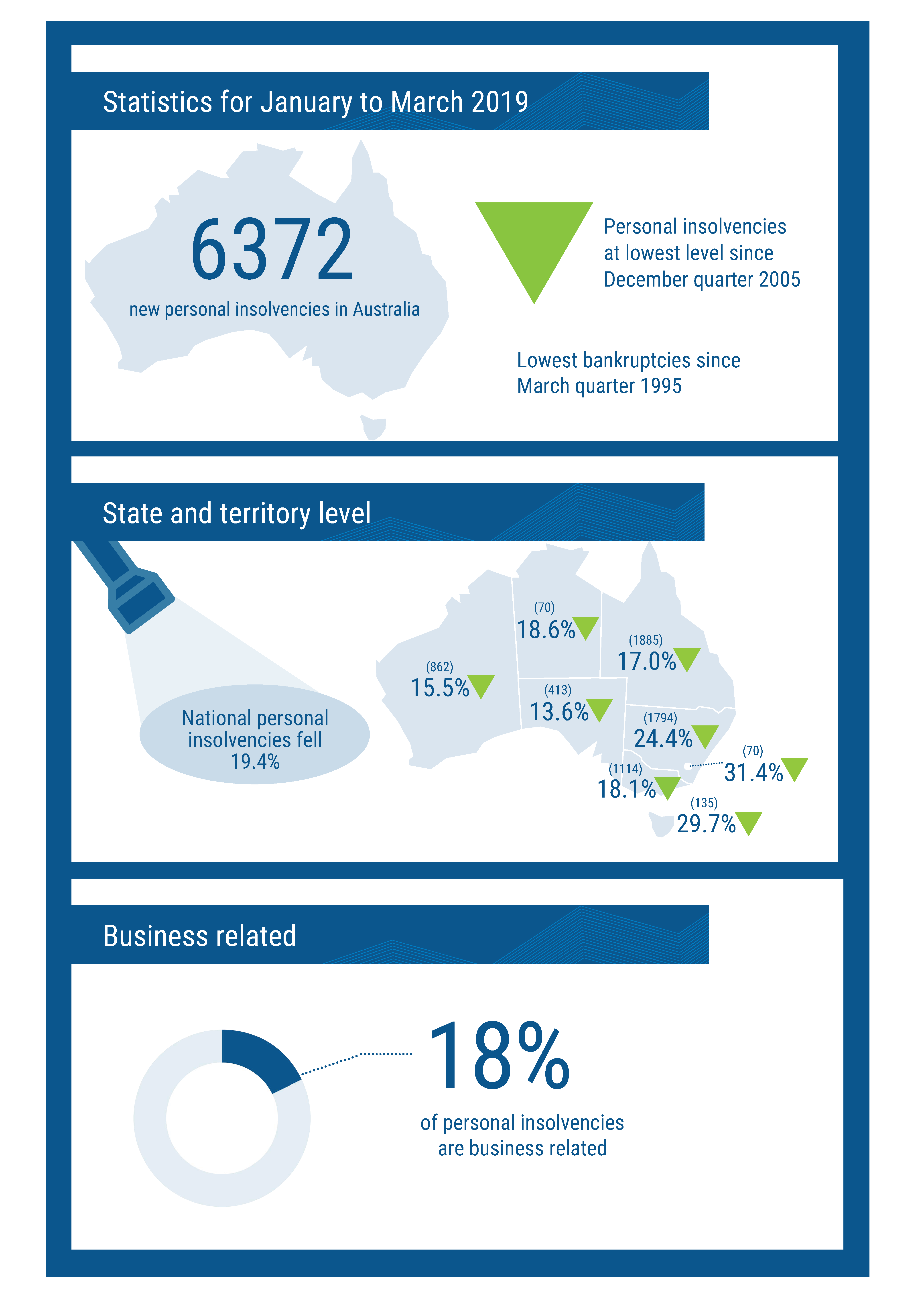

Are Australians finally learning how to manage their debt? That’s one takeaway from the March quarter 2019 personal insolvency statistics released by the Australian Financial Security Authority (AFSA), which reveals bankruptcies are at a 24-year low – their lowest level since the March quarter 1995. And that’s despite record levels of household debt and increasing mortgage stress.

The latest AFSA statistics show that there were 3,765 bankruptcies in the March quarter 2019, which is a drop of 9.2 per cent compared to the March quarter in 2018.

Falls in bankruptcies were recorded in all states and territories except the ACT, with Tasmania experiencing the largest year-on-year decline, at 37.5 per cent from 120 to 75. Queensland, however, recorded the largest number of bankruptcies nationwide, at 1,103 in the March 2019 quarter, down 12.6 per cent from 1,262 a year earlier.

Another positive was the lower number of business-related bankruptcies. In fact, 18 per cent of personal insolvencies were business related. “The general population is becoming more acquainted with insolvency-related issues and seeking advice earlier than what was historically observed. While there can be more done to improve this, the statistics seem to illustrate a more willingness of individuals to seek advice,” says Jirsch Sutherland Partner, Stewart Free.

The highest proportion of new debtors entering a business-related personal insolvency was in Western Australia, which could possibly reflect the impact of the end of the resources boom encountered a year ago.

“While the WA economy is rebounding, it may not have been quick enough in some sectors to stave off the financial impacts of the downturn,” Stewart explains.

“It’s vital for individuals, like with business owners and directors, to seek help before it’s too late. Whether they speak with their accountant or an insolvency specialist like Jirsch Sutherland, it could make a huge difference. In far too many cases, those who face bankruptcy don’t seek expert guidance.”

Accountants can play a vital role in identifying warning signs, such as their clients having financial difficulties and not being able to pay their debts. “There can be options to help, which is why it’s important to ask for assistance,” Stewart adds.

“If accountants or other trusted advisers have a client who is in need of expert advice regarding bankruptcy and turnaround solutions, Jirsch Sutherland can provide professional advice tailored to their individual circumstances. Our nationwide specialists understand the particular needs of businesses within their respective region, ensuring your clients receive the right advice regardless of what sector they operate in.”

The decrease in personal insolvencies may also be due, in part, to the 2017 changes to the Bankruptcy Act, which introduced regulation of debt agreement administrators. Now only registered debt agreement administrators can process the Part 9 debt agreements. The decrease in personal insolvencies will continue as there is to be tighter regulation of the debt agreement regime through the Bankruptcy Amendment (Debt Agreement Reform) Act 2018, which was passed through parliament in September 2018.

In a snapshot:

- Personal insolvencies were at their lowest level since the December quarter 2005

- There were 2,552 debt agreements in the March quarter 2019, a 31.5 per cent fall compared to the March quarter 2018. This is the lowest quarterly level since the September quarter 2013. They fell in all states and territories

- Total personal insolvencies fell 19.4 per cent in the March quarter 2019 compared to the March quarter 2018

- The national number of debt agreements over the quarter was 2,552 – down 31.5 per cent from the same period in 2018

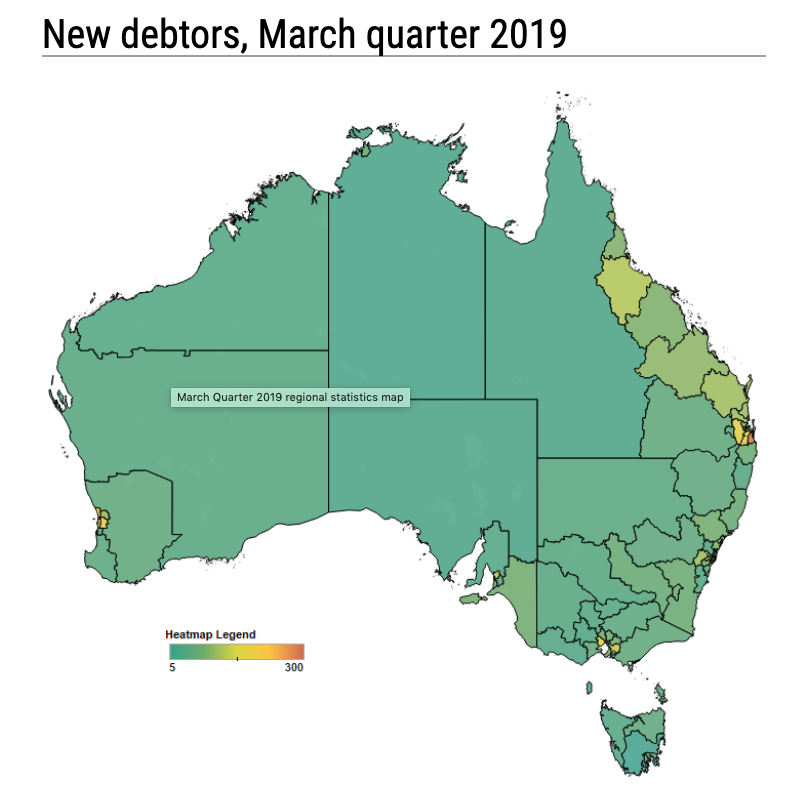

Regions with the most new debtors include:

- Australian Capital Territory: Tuggeranong (21)

- New South Wales: Newcastle (46)

- Northern Territory: Alice Springs (12)

- Queensland: Townsville (110)

- South Australia: Murray and Mallee (39)

- Tasmania: Launceston (28)

- Victoria: Geelong (40)

- Western Australia: Bunbury (33)