Tech-savvy millennials seeking instant gratification are turning to buy now pay later schemes like Afterpay and zipMoney to get their retail fix, enabling shoppers to make snap decisions on spur-of-the-moment purchases. With use of these digital platforms increasing five-fold from 400,000 to two million over the financial years 2015/2016 to 2017/2018, ASIC says it’s cause for concern.

Unlike old-school layby models, customers can take their purchases home immediately, without first needing to pay off installments. And, unlike banks, businesses in this sector are not currently required to lend responsibly or perform credit checks under the National Credit Act.

“My suggestion is that you give these companies a wide berth,” says Jirsch Sutherland National Managing Partner Bradd Morelli. “The convenience of services like Afterpay isn’t worth the additional money most people will likely spend.

“These companies understand the psychology of spending and are counting on your FOMO – fear of missing out – by encouraging you to spend more.”

While a small number of consumers are likely to use a budgeting tool to avoid overspending, data suggests that for most Millennials, the opposite is true when it comes to buy now pay later platforms. In fact, Australians in general are ditching credit cards in favour of debit cards and delayed payment services.

The latest Reserve Bank of Australia figures released last month, show that as of November 2018 there were 15.97 million credit card accounts, the lowest number since 2015.

“If the holidays have left you feeling uncomfortable and anxious about the credit card bill you’re about to receive, remember, now is the time for taking stock and looking forward,” says Bradd.

Consumers aren’t the only ones that need to be wary; these schemes can be the thing that tips a business over the edge. For example, Afterpay charges a $0.30 fee per transaction, followed by a commission rate fee that can range from 4-6 per cent based on the agreement. And because Afterpay is unable to issue refunds to shoppers on behalf of a merchant, their fees are non-refundable.

“Small payments may initially sound appealing, but they can influence you to make purchases you would not normally make upfront,” Bradd says. “And that could lead to bankruptcy if you are already struggling financially. My advice is to keep an eye on cash flow and pay your debts to avoid further financial distress.”

Sector’s exponential growth in ASIC’s crosshairs

The boom in buy now pay later platforms prompted ASIC to undertake a review, finding the number of transactions has increased from roughly 50,000 during the month of April 2016 to 1.9 million in June 2018. At 30 June 2018, there was $903m in outstanding buy now pay later balances.

The corporate watchdog examined six providers – Afterpay, ZipPay, Certegy Ezi-Pay, Oxipay, BrightePay and Openpay – four of which are part of larger ASX-listed companies, to gain a better insight into this growing industry and to identify probable risks for consumers.

“Although our review found many consumers enjoy using buy now pay later arrangements and plan to continue using them, there are some potential risks for consumers in using these products,” says ASIC Commissioner Danielle Press.

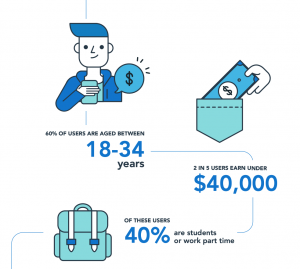

“The typical buy now pay later consumer is young, with 60 per cent of buy now pay later users aged between 18 to 34 years old. We found that buy now pay later arrangements can cause some consumers to become financially over-committed and liable to paying late fees.”

ASIC’s review also revealed that one in six users had either become overdrawn, delayed bill payments or borrowed additional money.

“The exponential growth in this industry, along with the risks we have identified, means this will remain an area of ongoing focus for ASIC,” Ms Press says. “One area we will be targeting is where consumers are paying more than they need to for using a buy now pay later arrangement.”

Stick to the payment plan to avoid interest or penalties

While Australian Retailers Association Executive Director Russell Zimmerman says this system isn’t entirely new, the concern is when people purchase products with no thought to the consequences. At issue is the speedy, almost instant approval process, which could easily lead some people facing bankruptcy because they can’t pay back their debts.

“It’s not a bargain if you decide to buy something that you can’t afford at the time, then get hit with a service fee or late payment penalty,” he says. “If you stick to the payment plan of these companies, there is no interest or penalties.”

While a customer might make a purchase with the intention to pay it back immediately, Mr Zimmerman says that unforeseen circumstances derail even the best budgets.

“You could find yourself out of work, or working less hours than you anticipated,” he explains. “It’s important that we as a community and as consumers, have control over our spending.”