The COVID-19 pandemic has had a large impact on the amount of receivables collected by the Australian Taxation Office. To date, the ATO has cut businesses some slack when it comes to it recovery policies, however, they have flagged a change in policy, so it’s important to be prepared.

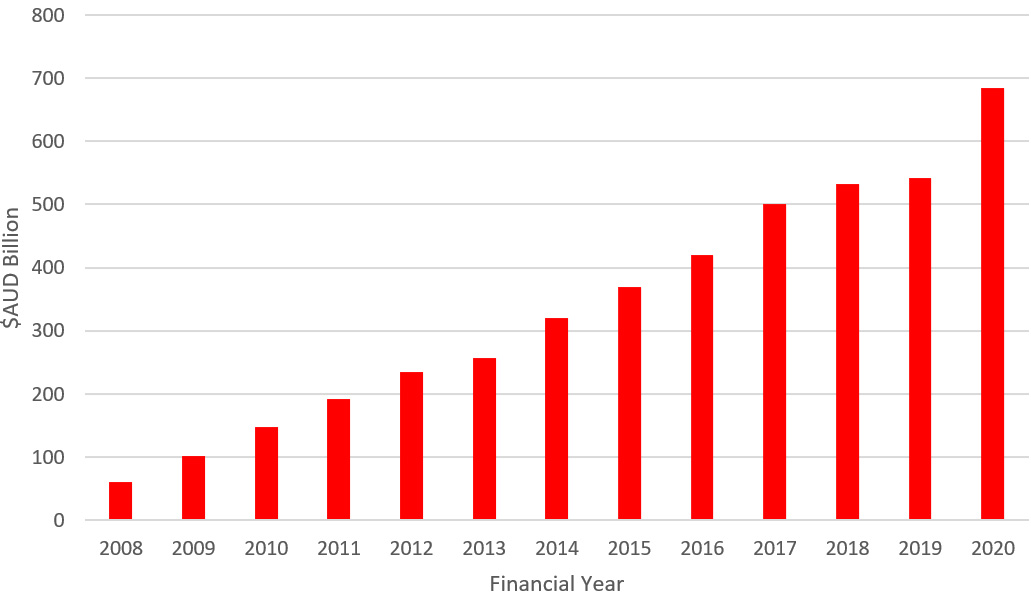

Despite COVID-19 still hampering business as usual, Australia’s economy is recovering well, with national GDP in the March 2021 quarter rising 1.8 per cent on the previous quarter. The outlook remains strong and is being supported by the federal government’s fiscal measures and current financial conditions. An expansionary fiscal budget is providing fuel for that growth, with government debt at historic highs, as shown in the following graph:

Australian Government Debt

Supporting businesses through and helping them get back on their feet after the pandemic has been a key aim of the federal government over the past 18 months, and part of that strategy is reflected in the ATO’s debt collection practices. Jirsch Sutherland Manager Hayden Asper says this generosity is reflected in the budget figures. The ATO suspended its normal collection strategy around April 2020 and, as a result, Australian businesses owe the ATO more than ever. Between July 1, 2020 and March 31, 2021, the ATO has initiated only six bankruptcies and three corporate wind-ups.

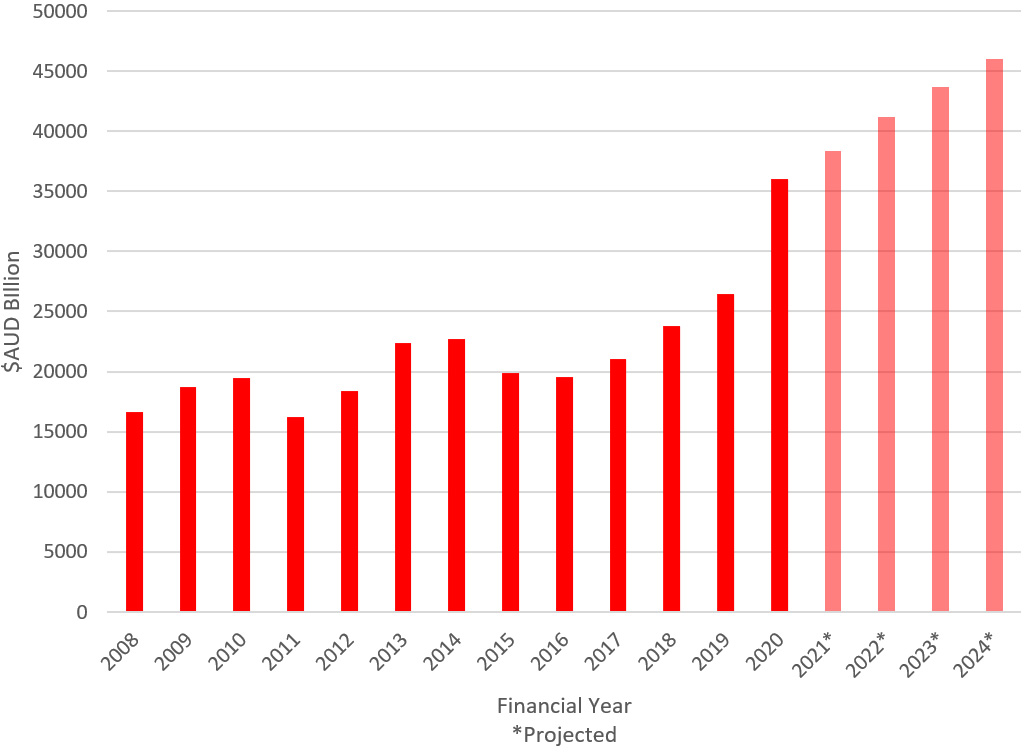

“The ATO’s change in strategy is reflected in the federal government’s ‘accounts receivable’,” Asper says. “In 2015 the budget recorded around $20 billion in uncollected taxes. By 2020, this had risen by $16 billion to $36 billion – that’s about a 75 per cent increase.” Tax receivable according to the relevant budget papers is recorded below:

Budget Papers: Taxes Receivable

He adds the forward estimates show the amount is going to keep creeping up, albeit more slowly, and that by 2025, there will be an estimated $46 billion in taxes outstanding. This means over a 10-year period (from 2015) the amount of uncollected taxes on the federal government’s balance sheet is projected to more than double.

Asper says it appears the federal government is yet to come down hard on businesses who are behind in their taxes, so it’s not surprising the uncollected amount is rising. “The 2021 budget papers do not project a surplus in 2022, 2023, 2024 or even 2025 – and budget papers are usually optimistic about future surpluses,” he says. “The current increase in uncollected taxes may indicate a federal government cash-flow issue. Every business owner knows they need to run a tight debtors ledger. The longer you go without collecting debtors, the less likely it is that they will be recoverable.”

Currently, the ATO is being proactive in asking businesses to set up payment plans if they can’t meet their full tax obligations and has been sending out letters on how they can do this.

“We expect to see further tolerance from the ATO,” Asper says. “The budget papers expect a further increase in taxes receivable over the next 12 months. After the pandemic and further lockdowns across the nation, the government wants to support small businesses. But it is good for businesses to be aware that within the next 12 months the nation will likely be vaccinated and the federal election over. So even if businesses with high tax debts are getting a bit of a reprieve at the moment, it’s not going to last forever.”

One interesting development is that in December 2020, the ATO updated the payment plan guidance section on its website, which included the removal of the detailed section on demonstrating ongoing viability. “While it’s difficult to know what the ATO’s actual internal policies are, that’s a hint that the ATO is not spending as much time assessing a business’s viability prior to approving a payment plan,” Asper says.

He adds that it is more important than ever for accountants and advisers to ensure their clients are up to date with their lodgements. If a company’s lodgements are up to date, then the ATO’s ability to personally pursue directors is severely hampered. “Directors are often hesitant to file their lodgements if they are unable to pay the resulting tax obligation,” Asper says. “They feel that filing a lodgement crystalises a tax debt. As counterintuitive as it may feel, the best way to protect themselves and their business is to ensure that all lodgements are filed on time.”

Firms such as Jirsch Sutherland are able to advise and help businesses who are struggling or concerned about their finances. “One thing to be aware of is that even if a business cannot pay their taxes, they should still report it,” Asper says. “The recent changes in insolvency law provide a suite of measures that allow insolvency practitioners to assist with simplified restructuring processes that make it quicker and simpler to assist small businesses with a formal restructure that may result in a reduction of tax debt.”

If lodgements have historically not been done on time, the ATO can issue a lockdown director penalty notice to recover PAYG withholding, superannuation guarantee charges, and GST. “If businesses have not always met their tax lodgement obligations, then receiving a DPN could result in very difficult circumstances for the directors,” Asper says. “It’s important to ensure all lodgements are met within the deadlines to avoid this. Even if you can’t pay, it’s important to make sure you report on time, otherwise directors could get stung personally in a severe way. If lodgements are up to date, there are simply more options on the table to deal with any financial distress. In addition, when we are assisting a business with a formal restructure, the ATO always consider lodgement history and often make bringing lodgements up to date a precondition of supporting any proposals.”

Send Your Enquiry

Our specialists are ready to help answer your questions.

Send your enquiry using the form below.

Trouble seeing the form? Email us directly at: enquiries@jirschsutherland.com.au