Personal insolvencies might have fallen in July but there’s a likely bounce coming because of the huge economic pressures faced by individuals and businesses, according to Jirsch Sutherland’s Bankruptcy Trustees.

Partner Stewart Free attributes the fall personal insolvencies to the still-running Government COVID payments and “a hesitancy from creditors to pursue to judgement”.

“The rise in personal insolvencies will take a little while to ramp up, but the combination of increasing interest rates, inflationary pressures, stagnant wage growth and the resulting decrease in disposable income will result in further pressure on household income,” says Free. “For many people, their income is the same but almost all outgoings have shot up, and this won’t be sustainable for much longer.

“I also expect to see an increase in business-led personal insolvencies, with ‘normalisation’ in around three months, ramping up to record levels in the next 12 months.”

Fellow Jirsch Sutherland Partner and Trustee Chris Baskerville says another factor for the low number of personal insolvencies in July is because “the ATO isn’t yet in full recovery mode”. “However, with the number of directors receiving Director Penalty Notices or statutory demands increasing on a daily basis, we’ll see a flow on to personal insolvencies,” he says.

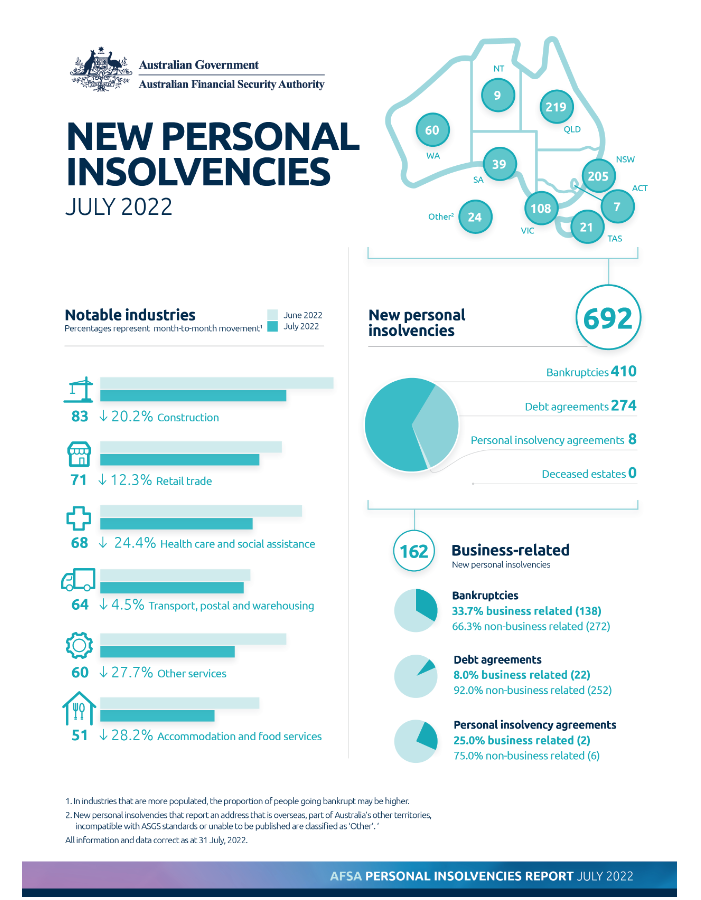

The AFSA (Australian Financial Security Authority) statistics for July showed that 138 people who declared bankruptcy were also involved in a business – down from 180 in June. “What I find interesting is that we’ve seen a significant increase in small business owners using the Small Business Restructuring (SBR) process, which is providing a lifeline and enabling directors to breathe new life into their companies. That could also explain, in part, why personal insolvencies have been low,” says Baskerville.

In July, the main industry sectors those filing for bankruptcy worked in were construction, retail trade, healthcare and social assistance.

“Looking at the construction sector, that’s certainly a reflection of the challenges this sector has been experiencing. I believe this will continue in the short term because the sector hasn’t yet hit rock bottom,” says Free.

“To anyone worried about their finances – personal or business – it’s important to note that these concerns don’t go away on their own. It’s vital to take action early and seek help from a registered professional at the first sign of financial distress. Too often bankruptcy is seen as a last resort; however, you’ll have more options available to you than if you wait for the problems to worsen, and a greater chance of finding a positive resolution.”