While the Personal Property Securities Act came into effect in 2012, there still remains some confusion as to when a registration should be in place and over what assets. As can be seen in recent cases, ignoring it can have dire financial consequence.

The Personal Property Securities Act 2009 (the PPS Act) is a federal legislation that came into effect on January 30, 2012 and changes the way security interests in personal property assets are governed. A security interest is defined as an interest in an asset that secures payment of a debt or obligation.

The PPS Act introduced the Personal Property Securities Register (PPSR), which is a notification board disclosing all registered security interests in personal property registered against either a company, an individual or a trust. The PPS Act applies to almost all forms of tangible and intangible property owned by any type of legal entity including money, goods, motor vehicles, hire purchase agreements, accounts receivable, long term leases, investment securities and documents of title. Exclusions include land, water rights and certain rights of entitlements created by statute.

Jimmy Trpcevski, a Principal at WA Insolvency Solutions says a security interest can arise when an exchange of goods has taken place and a contract exists. “At this point, the security interest needs to be registered on the PPSR,” he says. “There are a number of reasons for registering – the registration allows you a level of recourse to claim your interest in the event of an insolvent event.”

If you do not register a security interest and the business in possession of the asset becomes insolvent, you are classed as an unsecured creditor. “Creditors with registered security interests in property held by an insolvent entity (i.e. voluntary administration, liquidation or bankruptcy) will have a greater priority in the recourse to the title of the secured property,” he says.

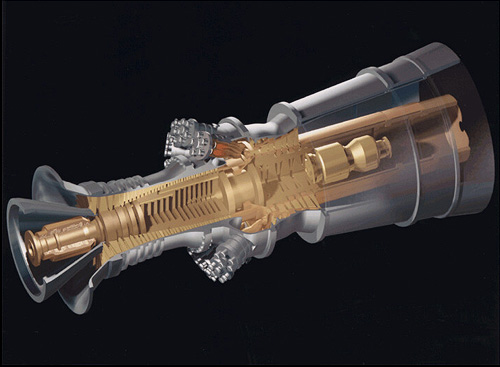

![By en:User:Blastcube (http://en.wikipedia.org/wiki/File:RC_drill_rig.jpg) [CC BY-SA 3.0 (http://creativecommons.org/licenses/by-sa/3.0)], via Wikimedia Commons](https://upload.wikimedia.org/wikipedia/commons/1/1a/RC_drill_rig.jpg) Jimmy cites the case of Forge Group Power (Forge) and General Electric International (GE). Here, GE had hired out a number of high-value turbines – worth $60 million – to Forge. But six months later Forge was placed into receivership.

Jimmy cites the case of Forge Group Power (Forge) and General Electric International (GE). Here, GE had hired out a number of high-value turbines – worth $60 million – to Forge. But six months later Forge was placed into receivership.

“As is often the case, GE left the turbines on site in the hope of securing alternative hire arrangements with neighbouring mining operations,” he explains. “Forge was happy as it avoided the demobilisation costs – but unfortunately these arrangements were verbal.”

Because the arrangements were not recorded in the PPSR, when the Receivers and Managers were appointed to Forge, they seized the turbines, arguing they were on hire, even though the equipment had not been hired for the previous six months.

“GE argued that it was not in the business of hiring, and that the turbines were fixtures,” explains Jimmy. “However, the Court ruled that it was a PPS lease and that it should have been registered.”

“GE argued that it was not in the business of hiring, and that the turbines were fixtures,” explains Jimmy. “However, the Court ruled that it was a PPS lease and that it should have been registered.”

As the rules stand, if a secured party fails to register its interest on the PPSR within 20 business days of the date of the security agreement being created and the debtor company (grantor) has administrators or liquidators appointed within six months of registration on the PPSR, then the security interest will vest in the insolvent company and the secured party loses its goods.

The cost of registering a financial statement for seven years or less is $6.80 while a search of the PPSR by grantor, serial or registration number is $3.40.

“There is no reason not to register a security interest,” Jimmy says. “The value in doing so outweighs the costs of registration every time.”