In just over six weeks’ time, a raft of key government support measures come to an end – in particular the insolvent trading moratorium and the temporary increase in the statutory demand threshold – which is why it’s more important than ever for business owners and their advisers to do a business ‘health check’ to identify any red flags. Directors could be liable if they don’t.

“December 31, when many of these measures come to an end or wind back, is fast approaching and while we have had these protection measures in place for eight months now, directors shouldn’t be lulled into a false sense of security; they’re not a long term proposition,” says Bradd Morelli, Jirsch Sutherland’s National Managing Partner.

“As recently stressed by ARITA, the professional body for insolvency practitioners, a company director who chooses to trade on an insolvent business past the December 31, 2020 deadline has no retrospective protection.

“Put simply, directors trading-on an insolvent business beyond that deadline will be exposed to the insolvent trading provisions throughout any period the company was insolvent, should the company later end up in liquidation. And that means retrospectively – from when the temporary COVID-19 Safe Harbour changes to the Corporations Act were instituted on March 25 this year.”

Morelli has a clear message: “Don’t leave it till January 1 to seek advice. Directors of a company that’s in financial distress should seek professional advice prior to the December 31 deadline. Early intervention could mean the difference between turning a business around or going into liquidation. Working with a business recovery/insolvency specialist also means that if you have been trading while insolvent, the matter will be handled in a controlled manner, mitigate risk and prevent against subsequent action once the insolvent trading moratorium ends.

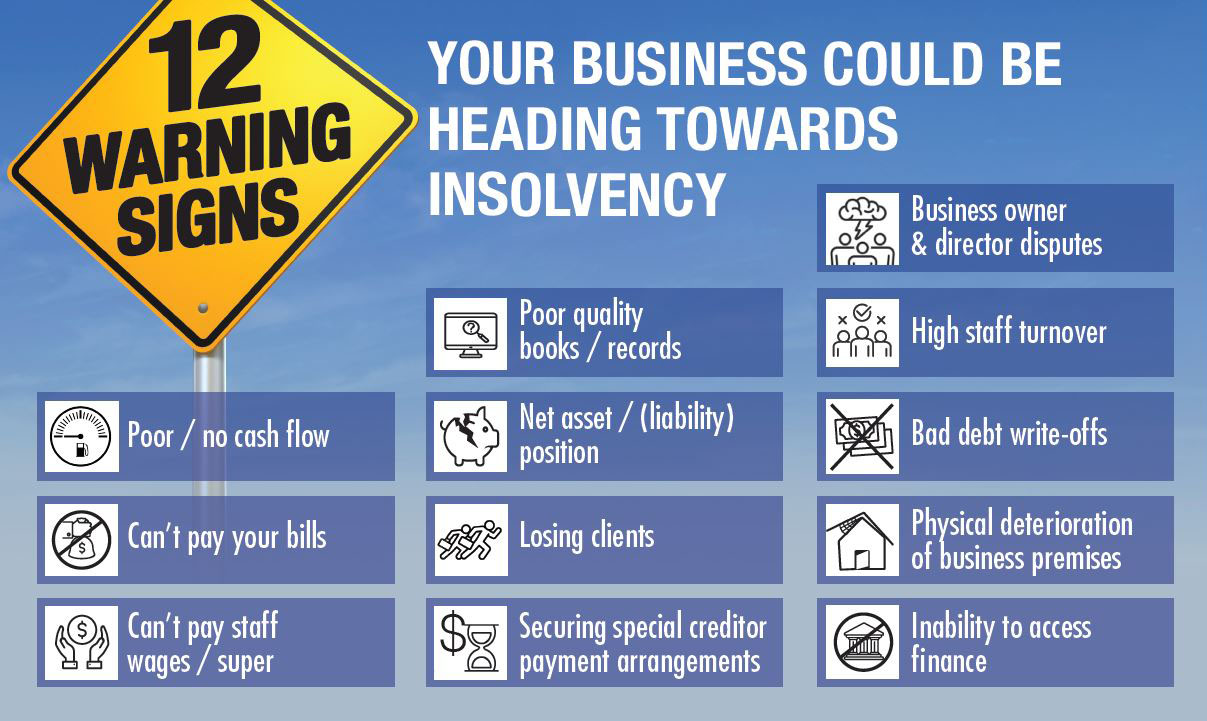

“By recognising the signs your business is in trouble and acting on them early, you could give your business the best chance of survival or to wind it up with minimal losses and achieve the best possible outcome.”