The number of personal insolvencies in the year to June 2021 has fallen by nearly 50 per cent. However, it’s largely believed it’s the federal and state governments’ financial incentives designed to help deal with the effects of COVID-19 that have largely contributed to this drop. So, does this mean the pain has been avoided or delayed?

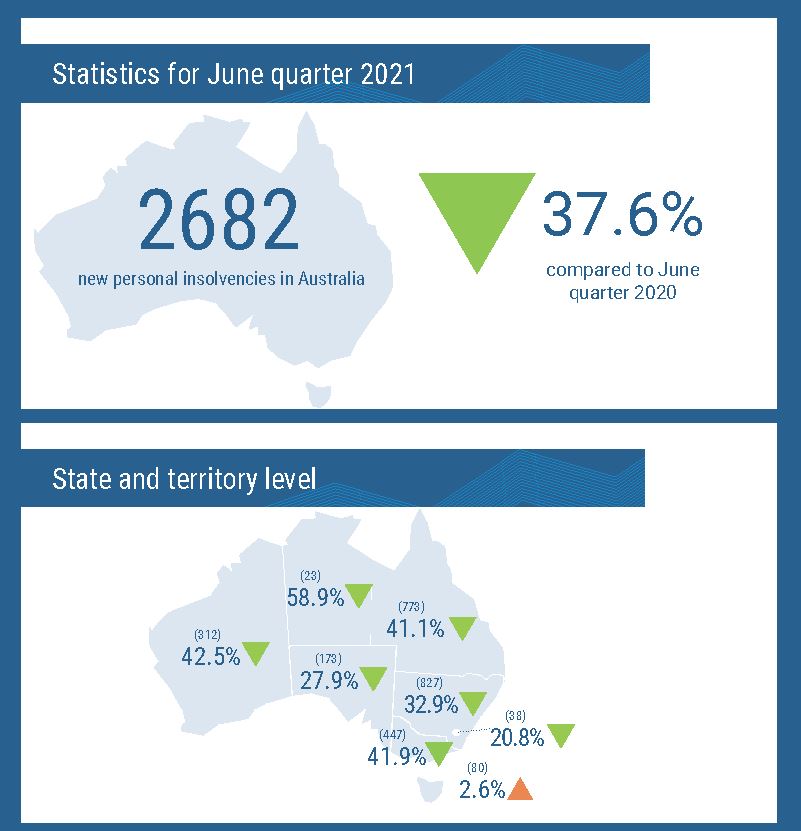

The latest statistics from the Australian Financial Security Authority show there were 10,621 new personal insolvencies in 2020-21, representing a near 50 per cent fall compared to 2019-20. During the June quarter of 2021, there were 2682 new personal insolvencies – a drop of 37.6 per cent compared to the June quarter of 2020.

What’s behind the low insolvency figures?

However, statistics can be deceptive and a fall in personal insolvency numbers doesn’t necessarily mean financial pressures aren’t building. While there are other factors keeping these numbers low, they won’t last forever. Legislative changes introduced throughout the pandemic were a huge help, such as increasing the size of the debt owed before a creditor could initiate action from $5000 to $20,000; allowing debtors six months as opposed to 21 days to respond to creditor demands, and having banks initiate mortgage-repayment deferrals.

Jirsch Sutherland Partner and Bankruptcy Trustee Malcolm Howell says the June 2021 quarter figures show a slight uptick in personal insolvencies compared to the March quarter (2545), but the reality is that they’re still very low. “Compared to pre-pandemic times, on average, personal insolvencies are around half what they would ordinarily be,” he says. “Most insolvency practitioners are very quiet at the moment.”

Howell puts the low personal insolvency numbers down to the following:

- The amount of government support provided over the past 18 months, which is continuing following the recent lockdowns, particularly in the extended Greater Sydney area.

- The Australian Tax Office, banks, and state revenue offices are not focusing on debt collection – yet. Their leniency is a result of the pandemic and the impact of the lockdowns on businesses and individuals.

- There are few pressure points – for example, the ATO isn’t using garnishee notices, nor are Director Penalty Notices being issued.

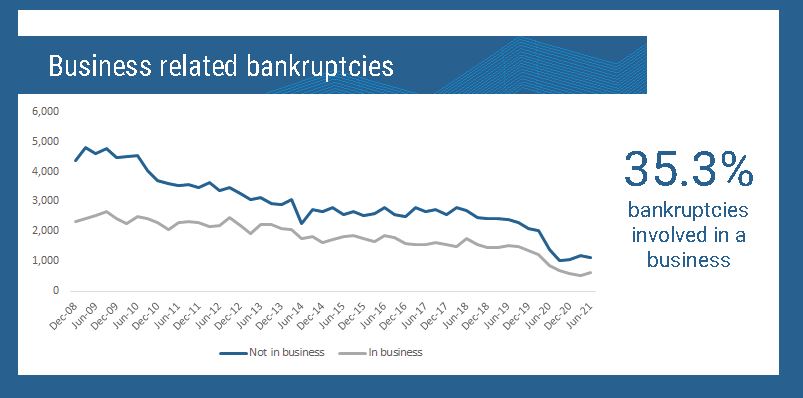

But, Howell adds, debts are mounting, and pressure will continue to build. He expects to see a continual, steady increase in personal and corporate insolvencies over the next six-plus months but adds the timing of any insolvency ‘tsunami’ is hard to predict.

“What we will see is an increase in pressure on businesses as they struggle to get staff and supplies,” he says. “Supply chains are being throttled by the pandemic and lockdowns and there’s a severe shortage in areas such as building and construction supplies. This will put immense stress on businesses.”

Avoid any false sense of security

It’s important for business owners and individuals to recognise if they are having financial troubles, especially as at some point the ATO, banks and other government departments will start collecting debts again. Howell says currently there is a lot of leniency and things are being put into abeyance.

“But if you suspect any financial distress, it’s best to speak with a trusted adviser now, rather than wait another six to 12 months,” he says. “The window of leniency could close at any time and there may be fewer options available if you wait.”

Howell stresses it’s important to look to the future and not just consider what’s happening today. “If you’re a business owner, you need to look at your cash-flow situation now and, say, 12 months down the track,” he says. “You need to plan for now and for the immediate and longer-term future.”

The same applies to individuals experiencing financial distress – they should be speaking with a trusted adviser such as an accountant, who are playing an even greater role in their clients’ businesses thanks to the pandemic. Howell says accountants should consider reaching out to their clients during these challenging times to see how they can assist.

“Accountants might also consider working with insolvency professionals to help determine what options are available for their struggling clients,” he says. “And remember, there are more options for individuals than just declaring bankruptcy. But it’s important to explore them as early as possible.