Malcolm Howell, one of Jirsch Sutherland’s seven Bankruptcy Trustees, has been handling personal insolvency matters for nine years – and he says he’s never seen as many financial pressures as what Australians are currently experiencing. The upshot, he says, will be an increase in personal insolvencies over the next six months and beyond.

“It’s a perfect storm: interest rate hikes, cost of living spiking, corporate insolvencies increasing and the ATO chasing debts. All of which will see a steady rise in bankruptcies over the next six months or more as levels normalise to pre-covid levels,” says Howell. “We’re also seeing landlords now starting to pull the trigger on bankruptcies because of unpaid rent, particularly those accumulated during covid times, while banks are more reluctant to advance funds, such as through loans or overdraft facilities, which business owners would have relied on to get over a financial hurdle. It means they can’t get the money from other sources.”

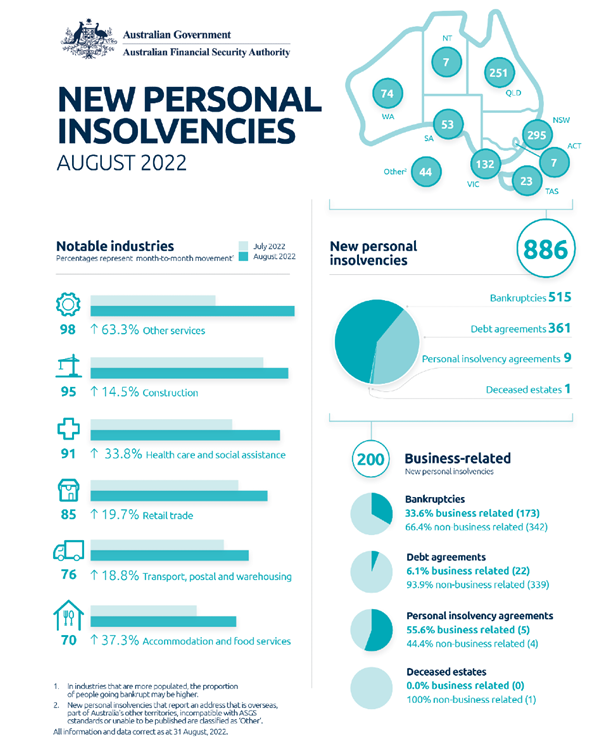

Howell’s insights are borne out by the latest personal insolvency statistics from the Australian Financial Security Authority (AFSA). During August, there were 886 new formal personal insolvencies – up from 692 in July.

“My colleagues and I have certainly noticed an upturn in inquiries over the past couple of months,” says Howell. “A lot of inquiries have been driven by credit card debt, particularly those attached to a company. It’s likely business owners are using credit cards to help finance their companies, so they are, in essence, robbing Peter to pay Paul. And as the banks and finance companies put pressure on people to pay, it’s having a domino effect. It also shows that personal guarantees are now coming into effect, and as we see more corporate insolvencies, this will lead to even more personal insolvencies. I expect the next six to 12 months will be crunch time, with bankruptcies returning to ‘normal’ pre-covid levels.”

Business-led insolvencies

According to the August AFSA figures, of those who declared bankruptcy, more than one third (173 people) were also involved in a business – up from 138 in July.

Fellow Jirsch Sutherland Bankruptcy Trustee Stewart Free also expects to see an increase in business-led insolvencies, ramping up to record levels in the next year. “For many people, their income has stayed the same while almost all outgoings have rocketed up. That won’t be sustainable for much longer,” he says.

“We might sound like a broken record, but it really is crucial to take action early and seek help from a registered professional at the first sign of financial distress. Bankruptcy is too often seen as a last resort. However, you’ll have more options available than if you put your head in the sand and let problems worsen.”