As more and more financially distressed businesses, not to mention accountants, become aware of the benefits of the Small Business Restructuring (SBR) process, they are turning to this still relatively young insolvency solution to resolve their issues. In the July-September 2023 quarter, Jirsch Sutherland experienced a significant uptick – over 200% – in SBR matters. We expect this number will keep rising.

At first, SBRs were an unknown quantity but now we are receiving an increasing number of enquiries from directors and trusted advisers wanting to know more about the process. And with the ATO getting more aggressive with their debt collection activities, that has prompted many into action.

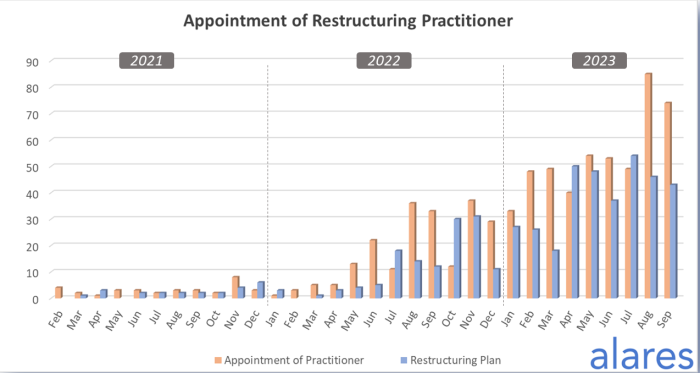

The latest Credit Risk Insights report by Alares reinforces the trend. It shows SBR appointments rose dramatically during August and September. Patrick Schweizer, Director of Alares and author of the report, says the spike might also explain the recent drop in ATO Court activity “as more small business owners seek help via the SBR process”.

“There has been a clear increase in the take up of the SBR process in the past two months, and there could be a few factors at play here. Firstly, many small businesses have now gone through the process in the past two years, so there’s generally a much better understanding of the process and the benefits among key stakeholders – i.e., small businesses, creditors, and restructuring practitioners. Secondly, another recent wave of Directors Penalty Notices (DPNs) from the ATO may be encouraging more small business owners down the SBR path,” says Schweizer. “A common message we hear from the ATO is that it would prefer not to wind up companies or bankrupt individuals, preferring less ‘terminal’ solutions to dealing with outstanding tax debts – and for many, one option is the SBR.”

Communication with creditors

The most appealing feature of the SBR process is the ability for directors to remain in the driver’s seat throughout the process. However, its success is in the planning and communication with the creditor group. A successful SBR must demonstrate why the business finds itself in a precarious financial position, as well as how those events or circumstances have been addressed and overcome, while also convincing creditors and other stakeholders that it’s in their interest to support the restructure. It means this process requires careful consideration to ensure it has the best chance of a successful outcome for all parties.

While the SBR matters Jirsch Sutherland is handling spans various industries, the three main sectors have been construction, retail and hospitality. The take up of SBRs in the construction sector may be as a result of the lesser licensing impacts in certain states, while retail and hospitality are as a result of rising costs and the decrease in consumer discretionary spending due to the cost-of-living crisis.

Regardless of the sector and reasons for financial distress, it’s crucial for directors to partner with an appropriately experienced SBR practitioner. Every scenario is unique and must be treated as such; there’s no cookie-cutter solution in corporate insolvency. Working with an experienced practitioner can be the difference between a successful outcome and being caught in a deeper hole.

We have 17 Small Business Restructuring Practitioners on our team and have handled scores of SBRs since the regime was introduced in January 2021. If you or a client need guidance about SBRs, we’re here to help. It’s important to act early to achieve the best possible outcome. Please don’t hesitate to call us on 1300 547 724 or email enquiries@jirschsutherland.com.au.

Andrew Spring

Partner / Small Business Restructuring Practitioner

Jirsch Sutherland