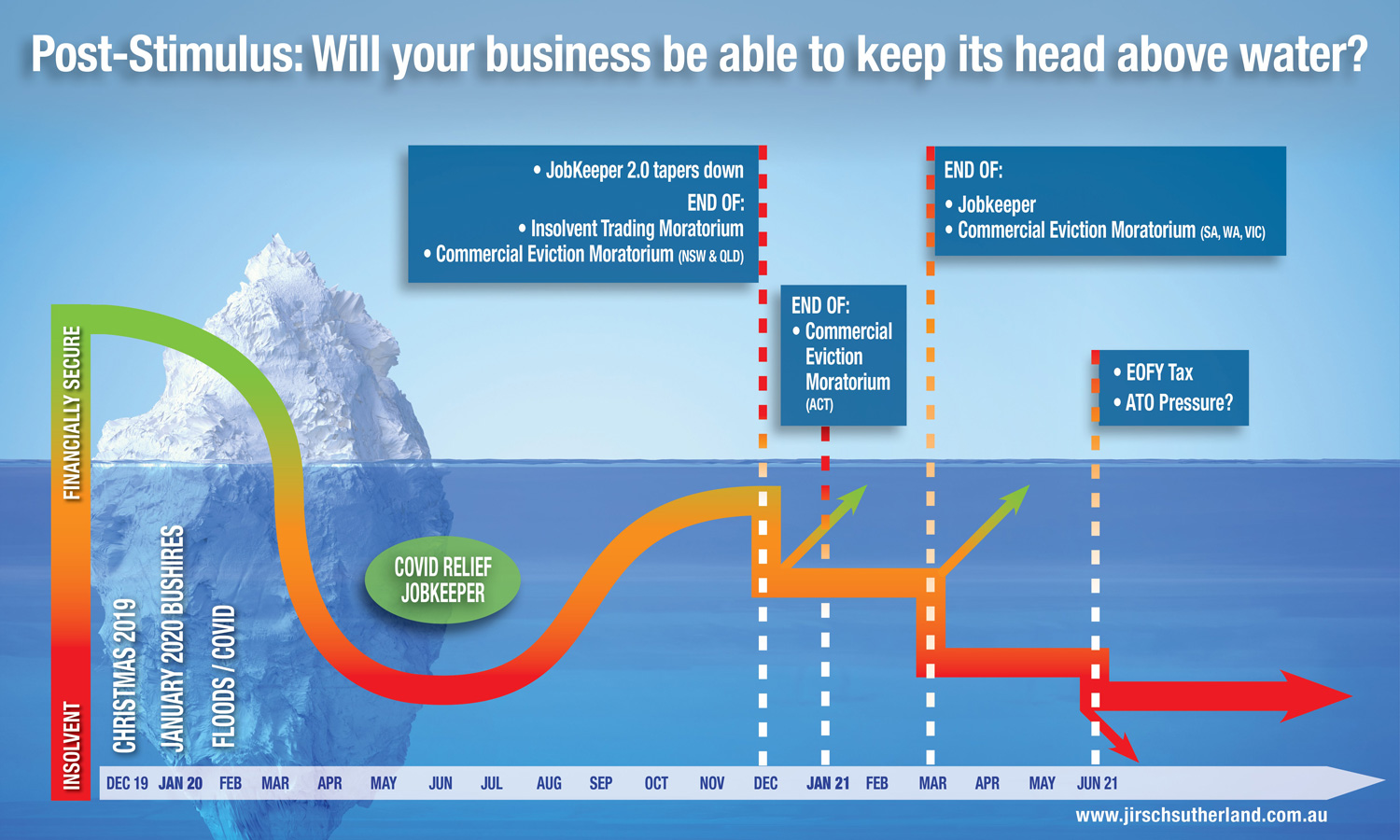

With the critical deadline of December 31 fast approaching, when the insolvent trading moratorium ends and other support measures finish or are cut back, Jirsch Sutherland Partner Andrew Spring says more businesses will likely be assessing whether they’re in a position to “keep their heads above water”.

“There are several deadlines looming over the next three months – the first one being on December 31, with the end of the relaxed insolvency laws, the final one being on March 31, when JobKeeper comes to an end,” Spring says.

“The $300 billion of government support measures have helped many businesses stay afloat but for some, they’ve acted as a temporary life raft. This is why it’s important for those businesses that have been relying on the assistance to know if they can remain above the water line of solvency once the support is withdrawn.”

The role of accountants cannot be underestimated at this time, Spring adds. “Businesses rely on accountants to monitor their performance and provide guidance on potential financial pitfalls – and this year this reliance has reached new heights,” he says. “With these critical deadlines fast approaching, now’s the time to touch base with clients to see how they’re faring and whether they need assistance to assess the health of their business, develop a strategy if they’re struggling, or plan for 2021.”

And while recent data shows business confidence has improved and fewer businesses are reliant on JobKeeper, Spring says there are many businesses still hurting that need assistance.

“As more stimulus measures are withdrawn, some businesses may find themselves drop further into financial distress,” he says. “Delaying a decision to address this distress makes the likelihood of returning to solvency more difficult.

“Sometimes unshackling the business from legacy debt will allow it to trend back up but the earlier that action is taken, the quicker the return to solvency. If left too late, the recovery is too far away to gain stakeholder support.

He adds sometimes the right option is to act to minimise the decline and losses suffered by the business and its stakeholders. “This is where Australia’s insolvency regimes come into play. They are support mechanisms designed to protect the people in the business, that is the owners, employees, customers and creditors.”

Taking such action, Spring says, can go a long way towards relieving the pressure so many people who are struggling are under. “Starting a conversation with a trusted business adviser might end up being the lifeline you need to stay afloat.”