If the rising insolvency figures are anything to go by, it’s never been more important for companies to undertake a business health check. This is to ensure the new financial year will be a productive and healthy one.

ASIC found that nationally, administration and liquidation numbers rose 17.2 per cent to 5520 in FY23, with Queensland businesses contributing 1004 (or a rise of 23.5 per cent year-on-year) to the number. Overall, the construction sector continues to comprise most of the business failures, but food and retail sectors are experiencing growing financial pressures. This is mainly due to rising interest rates and the high-inflationary environment. CreditorWatch found payment defaults within the food and beverage sector rose by 31 per cent in the year to May 2023.

These financial pressures are set to continue with the ATO now back on the debt-collection warpath. They are keen to claw back the estimated $30 billion owed to it by small businesses. The ATO’s amnesty on penalties for those who have failed to lodge their income tax or fringe benefits tax returns expires at the end of 2023, so now is a critical time to get houses in order.

Insolvency levels are likely to continue to rise in the new financial year. Revenue is expected to be tightened as interest rate rises continue to bite into people’s budgets. Even if you think your business is travelling well, it’s important to undertake a business health check to ensure you have a clear understanding of your position.

A business health check gives insights into your company’s financial health by providing an overview of its financial performance, compliance risk and key operational functions and processes. The idea behind such a check is to gain a greater understanding of the key areas of your business that may need attention. It gives you more clarity about what is occurring in your company and where any weaknesses may be affecting its potential for growth.

What to include in your business health check

The following are some of the key questions to ask:

- Is your company’s tax lodgement compliance up to date?

- Cash flow forecasts: Do you have one? how much money is coming in and going out?

- What’s your break-even point? What and how many do you need to sell to break-even?

- Are you making a profit?

- Financial buffers: how much cash do you have in reserve?

- Debt management: Are you constantly chasing up outstanding invoices

- Is there anywhere you can cut costs?

- Are you having regular conversations with your accountant or adviser?

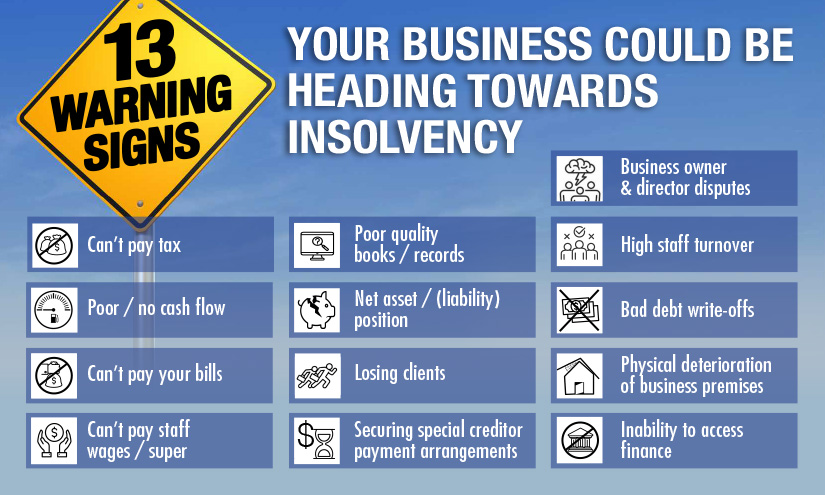

Insolvency warning signs

Your business health check may have identified potential insolvency risks. Two of the most common signs that may signal your business is in trouble, include issues around cash flow and an inability to pay bills. If you’re experiencing one or more of the following, it’s important to take early action:

- Poor cash flow or high cash use

- Sales dropping off

- Increasing debt levels

- Inadequate financial accounting information

- Loss of major clients – or clients who are in financial trouble

- Overdependence on one major client

- Inadequate working capital

- Consistently late-paying clients

- Non-lodgement of tax returns

- Non-payment of super or wages

- Late or non-payment of services such as rent

- High staff turnover

- Ineffective management and/or corporate governance

- Creditor demands increasing

While it’s one thing to realise your business is experiencing financial distress, it’s another thing altogether to do something about it. If you recognise these early insolvency warning signs for your business, it’s important to be proactive and to seek help early. The earlier you take action – such as a call to your accountant or adviser – the more options will be available to you, including restructuring.

Hanzel Hizola

Principal – Brisbane & Gold Coast QLD

Jirsch Sutherland